ANALYSIS: Nigeria’s budget and bogus oil benchmarks

In the last ten years, Nigeria has been unable to meet its oil production benchmark signifying a pattern of failing in executive planning and legislative approval of the country’s annual budgets

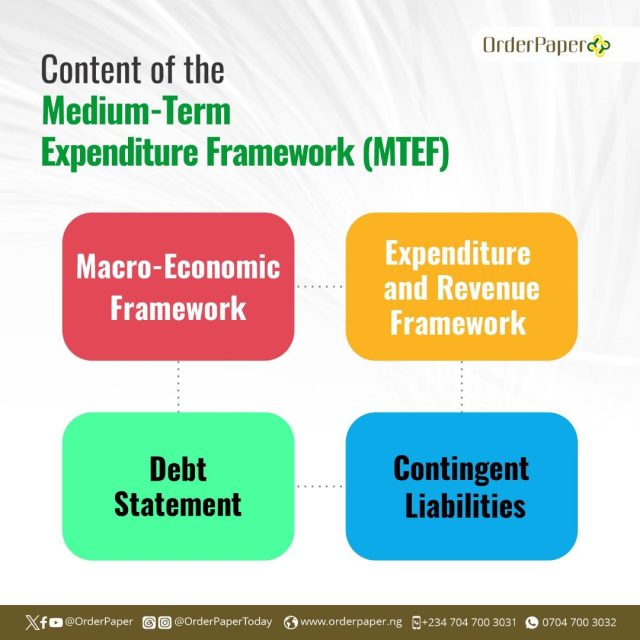

Nigeria set its first Medium-Term Expenditure Framework (MTEF) benchmark for crude oil in 2004, which was about 19 years ago. The MTEF provides a framework for Nigeria’s annual budgeting process, including revenue projections and expenditure estimates for a period of three years. It also helps guide the fiscal planning and macroeconomic management of the country.

Oil benchmark and OPEC production quota

The crude oil production benchmark contained in the MTEF every year is very important for a couple of reasons. Mark you, Nigeria is a member of the Organization of the Petroleum Exporting Countries (OPEC), the global oil cartel which maintains a production quota for its members.

Many Nigerians ask how the oil benchmark in the MTEF and annual budget is related to the OPEC quota and their importance to each other.

OPEC sets production targets and policies for the entire organization as a whole. The member countries, including Nigeria, then work together to determine their individual production levels within the agreed-upon OPEC framework. OPEC production quotas and other benchmarks like supply cuts are aimed at maintaining stability in global oil markets. Nigeria sends its production data to OPEC, which helps the organization monitor and assess each member country’s compliance with the agreed-upon production levels.

READ ALSO: INSIGHT: Oil, revenue and the MTEF benchmarks

Unrealistic, unmet benchmark…

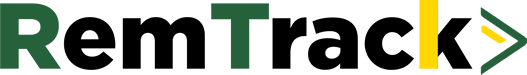

As much as the OPEC quota and annual benchmarks correlate, Nigeria has been unable to meet the thresholds proposed by the Executive and subsequently approved by the Legislature. This has been the case in the last ten years, as seen in the infographic above.

From the data, the closest the country has come to meeting the oil benchmark were in 2015 when the benchmark was capped at 2.28 mbpd and average production was 2.19 mbpd; and in 2020 when the benchmark was 1.8 mbpd and average production was 1.78 mbpd. It is also worthy of note that there has been a steady decline in the benchmark and the average production over the last ten years. This can be ascribed to a number of factors, including the intractable problem of oil theft.

Hasty approval of 2024-2026 MTEF

For a macroeconomic framework which is supposed to cover three years, it is expected that a lot of scrutiny is put into its approval by the national assembly after a painstaking preparation by the executive. Extensive stakeholder consultations and debates involving citizens at various levels ought to be integral processes of developing and approving the framework. It is a given that subject matter experts beyond the bureaucrats ought to make inouts into the process, not to talk of exhaustive consultations among Ministries, Departments and Agencies of Government. This expectation is why, perhaps the law provides that the MTEF be submitted to the national assembly at least four months before the end of the fiscal year. However, the way the 2024-2026 MTEF was approved by the National Assembly in less than a month leaves more to be desired.

In reviewing the proposed MTEF sent to the National Assembly by the Executive and the approved MTEF, one would notice little or no difference in both documents. Does this imply that the National Assembly made up of 469 members (360 members of the House of Representatives and 109 senators) had no counter position to what was proposed by the Executive? Or is another case of a rubber stamp legislature? Ironically, it can be seen in the 2024 budget proposal presented by President Bola Tinubu on November 29, 2023, that the Executive reviewed the some of the contents of the already approved MTEF (for example, the total expenditure was raised from N26.2 trillion to N27.5 trillion).

Minister of Budget and National Planning, Atiku Bagudu, explained other adjustments after approval of the MTEF to include exchange rate of 700 Naira per dollar and an oil price benchmark of 73.96 dollars. He stated that the Federal Executive Council (FEC) revised the MTEF to an exchange rate of 750 Naira to a dollar and oil price benchmark of 77.96 dollars in order to fund the eight priority areas of the Tinubu administration.

To many analysts, this adjustments after approval raises a red flag. It also suggests that had the MTEF not been hastily proposed and approved by the executive and legislature respectively, there would have been well-considered benchmarks and parameters, and indeed, better coordination between both branches of the government.

A NASS shirking its responsibilities

The posture of the National Assembly in approving crude oil benchmarks has left much to be desired. To understand the roles of both branches of the government on this matter, it is necessary to refer to the Fiscal Responsibility Act (FRA), 2007, which stipulates on the MTEF and annual budget. According to Section 18(1) of the Fiscal Responsibility Act 2007, “notwithstanding anything to the contrary contained in this Act or any other law, the Medium-Term Expenditure Framework shall be the basis for the preparation of the estimates of revenue and expenditure required to be prepared and laid before the National Assembly under section 81 (1) of the Constitution”

The 1999 Constitution (as amended) in section 80 and 81 gives the power of appropriation to the legislature. This means the budget proposal submitted by the President has to be processed and approved before it can become a law. This point was recently echoed by a former senator and ex scribe of the ruling All Progressives Congress (APC), Sen. Iyiola Omisore, who spoke at the maiden Citizens Townhall on the 2024 Budget and Appropriation Process, held in Abuja recently. Omisore, who is a former Chairman of the Senate Committee on Appropriation, said that the “Power of the Sword” lies with the Executive while the “Power of the Purse” lies with the Legislature. In his words “the budget as presented by the president means that the National Assembly has the power to look into it and see whether it satisfies Nigerians or not… the budget belongs to the parliament.”

From what is the established trajectory on oil production benchmarks over the years, the National Assembly is failing to exercise its powers judiciously. Year in, year out, data and statistics are released from the Fiscal Responsibility Commission (FRC), the Debt Management Office (DMO), Central Bank of Nigeria (CBN), the Nigerian National Petroleum Corporation Limited (NNPCL), the National Bureau of Statistics (NBS) and the Federal Inland Revenue Service (FIRS), among other relevant agencies of the government on the fiscal situation covering revenues, expenditures and debts. These are supposed to guide the ministry of finance in fixing the benchmarks. However, in the last ten years, one cannot say this is the case.

Possible solutions to the benchmark misses

To set realistic oil production benchmarks and meet them, the following solutions may be considered in whole or parts:

- Thorough research and analysis: The government should invest in comprehensive research studies and data analysis to assess the existing oil reserves, production capacity, and market demand. This will help in setting realistic benchmarks that align with the country’s resources and market conditions.

- Collaboration with industry experts: Engaging with industry experts, including oil companies, consultants, research institutions, and even civil society organisations, can provide valuable insights into oil production trends, technological advancements, and best practices. This collaboration can help the government identify realistic benchmarks and strategies to achieve them.

- Long-term energy strategy: The government can create a clear and comprehensive energy strategy that outlines the country’s goals, targets, and policies on oil production. This strategy should consider factors such as environmental sustainability, technological advancements, and market dynamics to set achievable benchmarks.

- Investments in infrastructure and technology: Adequate investment in oil production infrastructure, and mid/downstream value chains including pipelines, refineries, and transportation systems, is crucial to meeting production targets. It is time the unfinished and abandoned refineries are fixed and put to good use. This can be carried out in different ways including privatization and this is a great way to bring Foreign Direct Investment (FDI) into the country. Additionally, leveraging advanced technologies and adopting best practices will enhanc Dec 09, 2023 by Iseghohime Efe